Alger: Growth discounting a large opportunity?

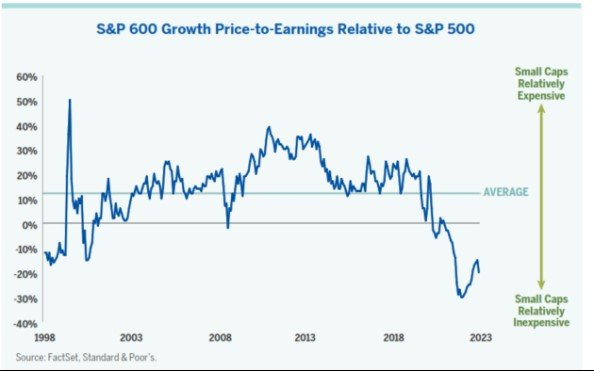

Over the past two decades, small cap growth stocks have typically traded at a price-to- earnings (P/E) premium relative to large cap stocks. But what are the implications when small cap growth is at a discount to large caps, as they are today?

- Historically, the small cap S&P 600 Growth Index has traded at an average premium of 12%, relative to the large cap S&P 500 Index as shown in the chart above. This makes sense given the faster growth that should be inherent in small cap growth fundamentals.

- As of March 31, 2023, the small cap growth index presented a P/E discount of about -20%. Moreover, small Cap growth stocks are currently trading at a P/E discount below February 2001 levels.

- We believe investors may want to review their equity allocations to small cap growth stocks, considering what is a historically big discount to large cap stocks.