Harry Geels: Inflation woes determined US election results

This column was originally written in Dutch. This is an English translation.

By Harry Geels, written in a personal capacity

In analyses of what happened during the last presidential election in the US, the theme of inflation increasingly comes up. Democrats fell victim to sharply higher prices. Donald Trump cleverly played on this with his proposed tax cuts.

In my column on the implications of Donald Trump's re-election as US president, I wrote that Trump had a concrete story for the ‘ordinary American’ and Kamala Harris did not. Harris did not actually get beyond a story about all Americans coming closer together and Trump steering towards further polarisation, while the Democrats themselves have actually become very polarised internally. Whereas Trump had a clear slogan with ‘Make America Great Again’ (2.0), Harris got no further than the occasional lukewarm repetition of Joe Biden's ‘Build Back Better’.

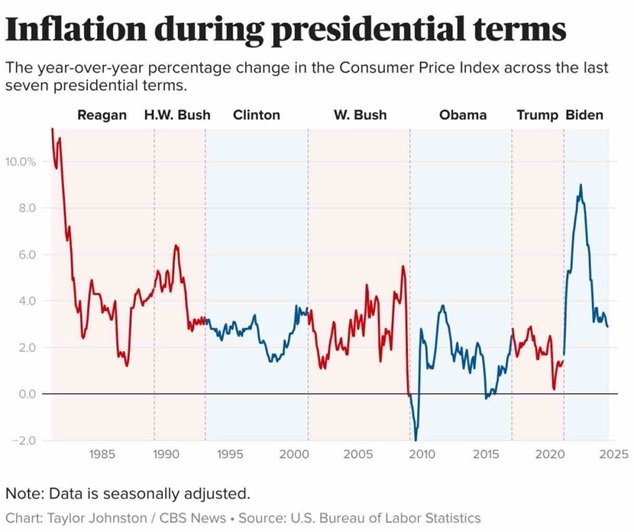

There was also another clear difference. Make America Great Again contained a personal message for Americans, a message of bringing jobs back to the US (with less competition from immigrants), less regulation and lower taxes. Harris' message was much more abstract, more policy-based, linked to a similar slogan from the boss of the World Economic Forum. And with that policy, Biden also went wrong, especially inflation policy. In the past 50 years, inflation never rose as fast during one administration as it did under Biden.

Figure 1 shows that inflation rose to 9%, at least as measured by the so-called year-over-year (YoY) inflation rate. After that, inflation seemed to come under control. So no problem, we might say, but that's not how it works in people's minds.

Figure 1

Experienced inflation

YoY inflation is not a good measure for consumers. What matters is the index. If prices rise by 9% in a year and an average of 3% is added in the following three years, total inflation, with compound interest, has risen 20%. The Big Mac became 25% more expensive during Biden's presidency. Inflation is not a cold number, as rightly noted here in Forbes, but a judgement call. It is different for everyone. Moreover, calculations are often tinkered with. Based on old calculations, inflation would have been even higher.

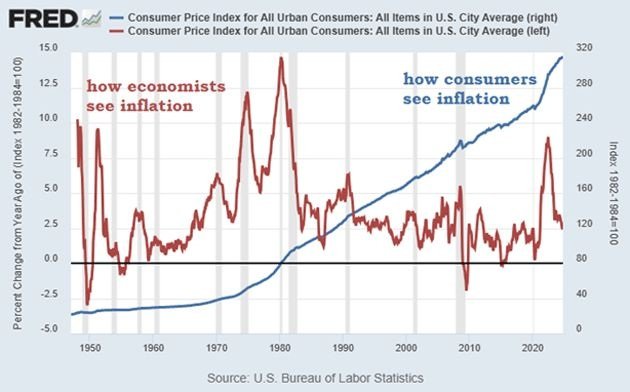

It also makes no sense when policymakers refer, sometimes condescendingly, to the ‘objective figures’. Former DNB president Nout Wellink, after the introduction of the euro, in which the guilder entered the euro too cheaply and led to high inflation, spoke of ‘experienced (felt) inflation’: people should not whine so much about it. But there is a big difference how (monetary) economists experience inflation and how ‘ordinary’ people do, as Figure 2 shows.

Figure 2

Economists think in YoY inflation, or percentage changes in prices year-on-year, ‘ordinary’ people think in how much less they are left with, or in the case of Americans: ‘My groceries got 25% more expensive under Biden.’

‘Biden couldn't help it’

It has been said that Biden could not do anything about inflation due to external circumstances (the central bank's extremely loose monetary policy, which started in 2020, still during Trump I, and then the war in Ukraine, which drove up the prices of many commodities). This is partly true, partly not. During Biden, the US budget deficit soared, partly financed by the Fed. Government spending is inflationary. So Biden threw oil on the inflation fire. Indeed, when the Fed started tightening, he worked against monetary policy by additional spending. Voters have a keen sense of these things, as the last election showed.

Condescending, but in a subtle way, was also the story of ‘temporary inflation’. Indeed, as argued earlier, temporary inflation does not exist at all unless inflation is followed by deflation, but that is rarely the case in practice. Central banks, remarkably supported by most financial journalists and economists, tried to use that term ‘temporary’ to downplay the problem of inflation, when in fact inflation is ‘one of the biggest diseases in society’. Inflation also actually amounts to a hidden tax.

Future

Inflation will remain an issue in the coming years, given the spending frenzy of many governments (even if only to pay the huge interest costs on debt) and climate change (for which the only real solution is pricing in negative externalities and not an SDG programme). Laterally, the rearmament of Europe, an ageing population and bringing production back to the home region (combined with possible higher import tariffs) could also lead to higher prices.

Government leaders seeking re-election thus have been warned with the US elections. Voters voted with their wallets, as so often happens.

This article contains a personal opinion by Harry Geels